In today’s evolving cybersecurity landscape, organizations face increasing regulatory and compliance requirements.

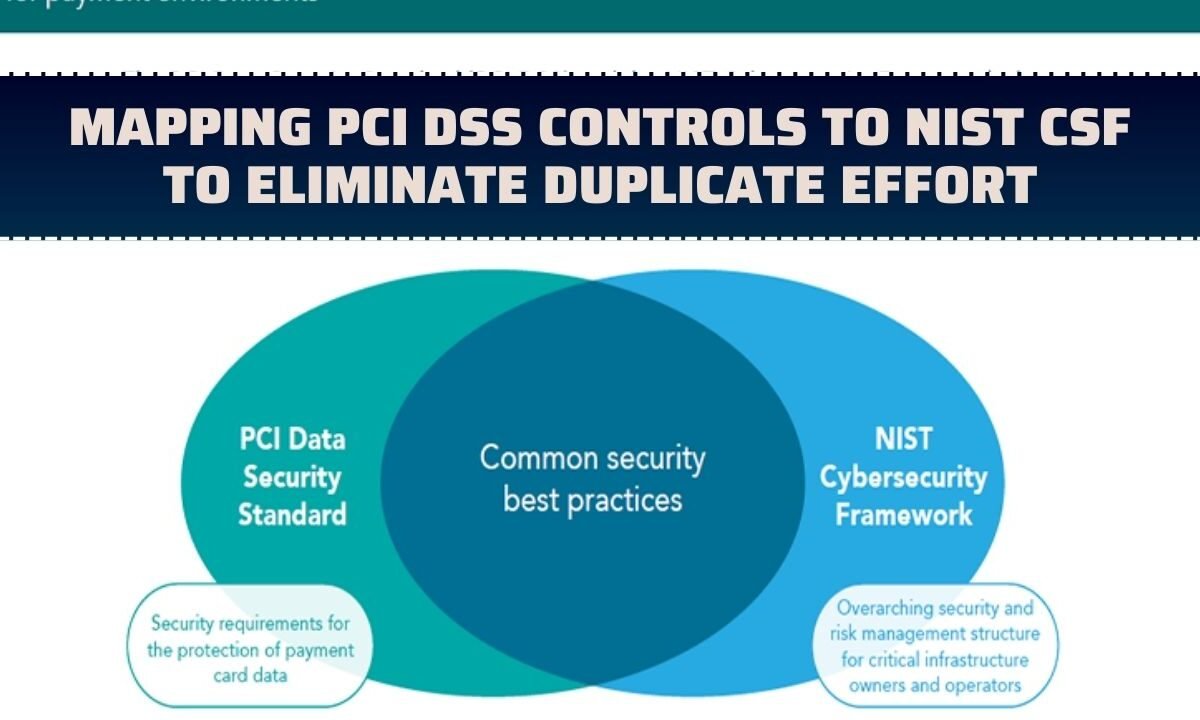

Payment Card Industry Data Security Standard (PCI DSS) and the National Institute of Standards and Technology Cybersecurity Framework (NIST CSF) are two critical frameworks that organizations often implement to protect sensitive data.

However, managing both frameworks independently can lead to redundant efforts, inefficiencies, and increased operational costs.

Mapping PCI DSS controls to NIST CSF is an effective strategy to streamline compliance, reduce duplication, and optimize cybersecurity practices. This guide explores the latest methods, best practices, and tools for aligning these frameworks efficiently.

Understanding PCI DSS and NIST CSF

What is PCI DSS?

The PCI DSS is a global security standard designed to protect cardholder data. It includes 12 core requirements and over 300 sub-controls that cover areas such as:

- Network security

- Access control

- Encryption

- Monitoring and testing

- Policy management

Compliance with PCI DSS is mandatory for organizations handling credit card transactions, including merchants, service providers, and financial institutions.

What is NIST CSF?

The NIST Cybersecurity Framework (CSF) provides a risk-based approach to managing cybersecurity threats. It comprises five core functions:

- Identify (ID) – Asset management, risk assessment, and governance

- Protect (PR) – Access control, awareness, data security, and protective technology

- Detect (DE) – Anomalies, event detection, and continuous monitoring

- Respond (RS) – Incident response planning and mitigation

- Recover (RC) – Recovery planning and improvements

The NIST CSF is flexible and applicable across industries, making it ideal for organizations looking to implement a holistic cybersecurity strategy.

Why Mapping PCI DSS to NIST CSF Matters

Organizations often struggle to implement multiple cybersecurity frameworks simultaneously, resulting in:

- Redundant audits

- Duplicate documentation

- Inconsistent policies and procedures

Mapping PCI DSS controls to NIST CSF allows organizations to:

- Eliminate duplicate effort

- Simplify audits

- Optimize resource allocation

- Enhance overall cybersecurity posture

By aligning controls from both frameworks, companies can reduce compliance fatigue and focus on strategic risk management rather than administrative tasks.

Key PCI DSS Controls and Corresponding NIST CSF Functions

Below is a table showing the primary PCI DSS requirements mapped to NIST CSF core functions, helping organizations identify overlap and streamline efforts:

| PCI DSS Requirement | Description | Mapped NIST CSF Function | Notes |

|---|---|---|---|

| 1. Install and maintain a firewall configuration | Secure network boundaries | PR (Protect) | Network segmentation and protective technology alignment |

| 2. Do not use vendor-supplied defaults | Secure configuration | PR (Protect) | Enforces system hardening and baseline standards |

| 3. Protect stored cardholder data | Data encryption and masking | PR (Protect) | Supports data security and cryptographic practices |

| 4. Encrypt transmission of cardholder data | Data in transit protection | PR (Protect) | Aligns with secure communications standards |

| 5. Use and regularly update antivirus software | Endpoint security | PR (Protect) | Preventive controls for malware detection |

| 6. Develop secure systems and applications | Secure development lifecycle | PR (Protect) | Ensures secure coding practices and vulnerability management |

| 7. Restrict access to cardholder data | Role-based access control | PR (Protect) | Access management and identity control alignment |

| 8. Identify and authenticate access | Strong authentication | PR (Protect) | Multi-factor authentication and credential management |

| 9. Restrict physical access to data | Physical security | PR (Protect) | Supports NIST CSF physical asset protection |

| 10. Track and monitor all access | Logging and monitoring | DE (Detect) | Event monitoring, anomaly detection, and auditing |

| 11. Regularly test security systems | Vulnerability assessment | DE (Detect) | Continuous monitoring and testing alignment |

| 12. Maintain an information security policy | Governance and policy | ID (Identify) / PR (Protect) | Risk management and organizational policies alignment |

This table demonstrates that most PCI DSS requirements align with NIST CSF’s Protect (PR) and Detect (DE) functions, helping eliminate redundant controls and audits.

Steps to Map PCI DSS to NIST CSF

Step 1: Identify Overlapping Controls

Begin by reviewing all PCI DSS controls and comparing them against NIST CSF subcategories. Identify areas of overlap, such as:

- Encryption standards

- Access control measures

- Logging and monitoring practices

Step 2: Create a Crosswalk Document

Develop a crosswalk table that links each PCI DSS control to the corresponding NIST CSF function and subcategory. This document acts as a single source of truth for compliance efforts.

Step 3: Align Policies and Procedures

Update existing information security policies to incorporate both PCI DSS and NIST CSF requirements. This ensures that each policy addresses:

- Technical controls

- Operational processes

- Audit requirements

Step 4: Optimize Monitoring and Reporting

Consolidate monitoring and reporting systems to track compliance against both frameworks. This reduces duplication in audit logs, security reports, and vulnerability assessments.

Step 5: Conduct a Gap Analysis

Regularly perform gap assessments to identify areas where PCI DSS controls may not fully align with NIST CSF subcategories. Address these gaps through additional controls or process improvements.

Step 6: Continuous Improvement

Integrate continuous monitoring and risk assessment practices to maintain alignment. Leverage automation tools and compliance software to reduce manual effort and improve efficiency.

Benefits of Mapping PCI DSS to NIST CSF

Mapping these frameworks provides tangible benefits for organizations, including:

- Reduced Compliance Costs: Fewer audits and duplicated processes save time and resources.

- Improved Cybersecurity Posture: Unified control implementation strengthens defenses against cyber threats.

- Simplified Reporting: Crosswalk documentation allows auditors to verify compliance quickly.

- Strategic Risk Management: Focus shifts from administrative tasks to proactive risk mitigation.

- Regulatory Readiness: Organizations are better prepared for PCI DSS assessments, NIST CSF audits, and other regulatory requirements.

Tools and Technologies for Mapping and Automation

Organizations can leverage modern Governance, Risk, and Compliance (GRC) platforms to automate the mapping process. Key capabilities include:

| Tool Feature | Description | Benefit |

|---|---|---|

| Policy Management | Centralized repository for security policies | Ensures consistent documentation across PCI DSS & NIST CSF |

| Automated Crosswalk | Maps PCI DSS controls to NIST CSF subcategories | Reduces manual effort and errors |

| Compliance Dashboards | Real-time compliance tracking | Simplifies audits and reporting |

| Risk Assessment Modules | Identifies gaps in control implementation | Supports proactive remediation |

| Audit Trail Logging | Tracks changes and approvals | Improves accountability and regulatory readiness |

Implementing these tools ensures continuous alignment and reduces duplicate efforts, especially for organizations handling large-scale cardholder data environments.

Best Practices for Effective Mapping

- Engage Stakeholders Early: Include security teams, IT, and compliance officers in the mapping process.

- Standardize Documentation: Use consistent templates, naming conventions, and crosswalk formats.

- Prioritize High-Risk Controls: Focus on areas with the greatest impact on data protection.

- Leverage Automation: Use GRC platforms to track and manage overlapping controls.

- Regularly Review Frameworks: PCI DSS and NIST CSF evolve; ensure continuous updates to maintain alignment.

Common Challenges and How to Overcome Them

| Challenge | Solution |

|---|---|

| Conflicting control requirements | Conduct a detailed gap analysis and implement a harmonized control approach |

| Manual mapping complexity | Use automated tools and software to reduce human error |

| Continuous updates to frameworks | Assign dedicated personnel to monitor changes and update crosswalk documentation |

| Resource constraints | Prioritize high-risk areas and implement phased alignment |

Mapping PCI DSS controls to NIST CSF is a strategic approach to reduce duplicate compliance efforts, improve cybersecurity posture, and streamline audit processes. By creating a detailed crosswalk, leveraging automation tools, and following best practices, organizations can efficiently implement both frameworks without unnecessary redundancy.

This integrated approach not only reduces operational costs but also strengthens data protection and prepares organizations for future regulatory requirements. By embracing this methodology, companies can focus on strategic risk management and proactive cybersecurity measures, rather than repetitive compliance tasks.

FAQs

Yes, by mapping PCI DSS controls to NIST CSF, organizations can eliminate duplicate efforts and consolidate compliance activities.

The mapping should be reviewed annually or whenever there is a major update to either framework to ensure ongoing alignment.

Automation streamlines mapping, tracks compliance, reduces errors, and improves efficiency in PCI DSS–NIST CSF alignment.